Building and scaling a best-in-class customer experience is already challenging for most companies. It gets an order of magnitude harder when you need to cater to two or more types of customers whose interests are sometimes at odds with each other. Oh, and to make it even harder, you don’t even have full control over the experience; in fact, a big part of it is delivered by some of those customers you are trying to please.

That sounds like a nightmare, but this is the reality of building a successful two—or three-sided marketplace. At Chattermill, we’ve been lucky to work with some of the most successful marketplace companies, such as Uber, GetYourGuide, JustEatTakeaway, and Faire, among many others.

In today’s newsletter, I'm going to summarise some of our key learnings and the main use cases we see in this industry.

Learning 1. Small changes have outsized consequences

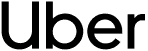

While we firmly believe that customer experience quality drives revenue in any business, in marketplaces, this happens even more due to the flywheel nature of the business model. Let’s say you have a relatively straightforward two-sided marketplace, such as Etsy, with buyers and sellers. Any tactic that would improve the experience of buyers would not only bring more buyers to the platform but, as a second-order effect, also make the platform more attractive for sellers, bringing more of those. Having more sellers will, in turn, improve the range and prices, leading to more buyers. And so on and on. This means any impact you estimate of a change in customer experience should have a multiplier attached. The specific number will be different for each business. This is an important number to know if you are going into a budget planning meeting.

The problem, though, is that the flywheel also works in reverse. Imagine the marketplace introducing a poorly considered UI change that prevents customers from purchasing. This has a direct negative impact on sales and will also make the platform less attractive for sellers (restaurants, drivers, hosts, etc.), which will, in turn … you get it.

The key conclusion is that marketplaces, more than most other business models, must pay close attention to the quality of customer experience on all sides of the platform.

Learning 2. You CAN significantly improve the experience on the platform

Sometimes, when speaking to marketplace decision-makers, you get a certain sense of apathy because they conclude that they don’t really control the most important parts of their customer experience. There is some truth to that. Uber can build a fantastic app and develop best-in-class route planning algorithms, but these achievements can easily be undone by one rude driver or even something as trivial as a choice of music in the car.

And yet, working with the best marketplaces we have seen that change is very much feasible. And it’s not just the hygiene tactic of removing low-rated providers (or those with specific complaints). Successful marketplaces design a system where providers' interests align with the platform's interests. For example, most food delivery apps such as DoorDash, Deliveroo, or JustEat design their algorithms so that higher-rated providers get more orders. This is because of the flywheel effect I mentioned above.

And no matter what the skeptics tell you, we find that providers are keen to improve. They just need insight on what to improve that is timely, relevant to them, and comes in a format they can understand and action.

Here’s how this works:

- On the provider side of your platform, provide scores on key aspects of customer experience extracted from the verbatims supplied with reviews. It is best not to ask customers to leave 3-4 ratings but to pull those out of the review text itself using AI. For most marketplaces, 3-4 ratings will not be enough. You need to find the most relevant ones for each category. For example, kid-friendliness is very important for a Disney World hotel but much less so for an airport hotel near a business center.

- These scores need to include a time comparison (this month vs. last month) and a benchmark, which can be either geographic or category-based (e.g., vs. all North London restaurants).

- Once we are done with quantitative insights, which is crucial, we can use GenAI to provide detailed context on what needs to change that is personalized to each provider.

On occasion, the insights are so good they can also be disseminated to all providers as part of the education materials, training, onboarding etc. Early on working with a ridesharing customer in South America, we found that simple tactics such as asking the customer if they would prefer air conditioning and offering them a bottle of water could generate significant customer experience gains (which in that market at that time would translate directly into market share gains) at very little cost to the business. This is the level of detail and actionability you want.

Learning 3. Do not underestimate the word of mouth effect

These days, you hear a lot less about word of mouth and virality. We believe that is a mistake. One of the biggest reasons to overinvest in amazing customer experience in marketplaces is that these models spread like wildfire if customers are very happy. Airbnb and Uber both spread largely by word of mouth in their early days. And yes, this was powered by a lot of venture capital, but the reason both companies spread as quickly as they did is that customers wanted to recommend them.

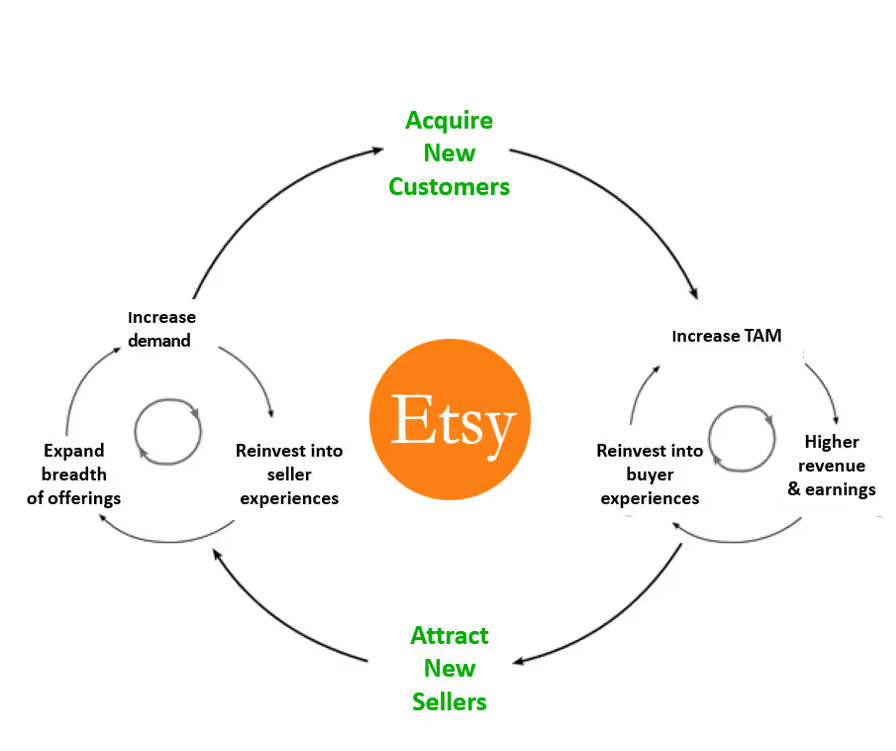

What this means is that while it’s important to analyze problems in your business (see learning 1 above), it is equally important to understand the drivers of positivity and promotion. Here’s how Brian Chesky, the founder and CEO of Airbnb, talks about this:

“If you want to build something that’s truly viral you have to create a total mindf**k experience that you tell everyone about. If I say, ‘What can I do to make this [product] better?’ you’ll say something small. If I were to say, ‘Reid, what would it take for me to design something that you would literally tell every single person you’ve ever encountered?’ You start to ask these questions and it really helps you think through the problem.”

Airbnb developed a framework they call the 11-star experience. You can read more about it here, but the gist is that they always consider what it takes to deliver an experience far ahead of customer expectations. And yes, 11 stars on a 5-star scale.

Learning 4. The job is never done

Even more so than other business models, marketplaces need to constantly adjust their strategy based on their current dynamics. This means figuring out which side of the marketplace needs more love at any given moment and quickly prioritizing accordingly. In an ideal world, all sides should get love all the time, but the reality is companies have limited resources and need to focus. Understanding the state of play on the platform and always having a prioritized list of initiatives for each side is crucial.

After the pandemic, Uber had a major issue on the driver side of the marketplace. In response, leadership launched a company-wide mission to solve long-standing driver issues. As hard as this was, the initiative worked, and Uber celebrated becoming a growing, profitable business that now won market share in its key markets. And yet, some of the improvements for drivers made the platform less appealing for riders. Overall, this was still a net positive, given driver availability is by far the key factor in the quality of experience. That said, Uber can bring the two sides in balance by investing in better experience on the customer side.

Learning 5. Beware of the ratings

Star ratings have been a staple of measuring the quality of experience in marketplaces since the time of eBay and Amazon, for good reason. They are simple, everyone knows what they mean. But, there are a lot of hidden issues with purely quantitative rating systems:

- Rating inflation. Over time, ratings tend to grow even if there’s no specific quality improvement. Some of it is due to reciprocity and some due to norming (eg. people learning that a 4 star review is bad).

- Averaging. A typical approach is to present an average rating. That is indeed the most logical. But the average on a five-point scale typically doesn’t change too much after a few ratings, thus generating less actionable information

- Criteria Differences in Segments You know how Harry Potter movies always get a higher rating on IMDb than most Cannes award winners? As much as I love Harry Potter movies, I think this is mostly because the audiences are different and have different criteria. Often, a segment of your customers may be biased up or down in terms of ratings in the same way.

To address this problem, top marketplaces supplement the purely quantitative ratings with insights extracted from the feedback, often aiming to present a balanced picture. Of course, there is some bias in the comments, too, but as it happens you still provide a lot more context in the written text vs on a five-point scale. This data can also be used to improve the listing and matching algorithms. Here’s an example from Amazon:

Parting thoughts: you are not alone

If you are working or considering working for a marketplace, I hope these learnings are useful. If nothing else, I hope they affirm your experience and give you some ideas for trying things. At Chattermill, we are always happy to talk you through the challenges and opportunities you see and brainstorm solutions based on our experience working with dozens of marketplaces over the years. Don’t hesitate to reach out by replying to this email or find me on LinkedIn.

.png)