Trouble in VoC paradise

The Voice of the Customer (VoC) has come a long way in the last 20 years.

The rise of powerhouses like Qualtrics and Medallia, as well as the mass adoption of techniques like NPS, has meant that VoC has become a hot space complete with huge IPOs and basketball team buying founders.

However, like a massive ship heading for an iceberg, the VoC party is about to come to an end.

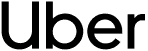

Surveys are the lifeblood of all VoC and Market Research programs and the bad news is that survey response rates are at an all-time low and falling.

This is seen in multiple studies and we see this among our clients.

It is important to note that we mostly refer to surveys sent by email either after a transaction or randomly to an existing customer.

Without a decent response rate to surveys, insights gleaned from surveys will stop being reliable, or of any value for that matter, because the surveys will be answered by fringe customers and not representative of your actual customer base.

We already see this happening among our clients where response rates to NPS and CSAT surveys have fallen from heights of 10% in some cases to low single digits over the last six years.

This in turn causes decision makers to (legitimately) question the reliability of customer insights and whether the survey-based VoC programme is still a worthwhile use of budget.

Specifically, the risk of a low response rate is the data you are collecting comes from the fringes of your customer base who are either very happy or very upset - this can give you a very polarized view of your customer experience which in turn can mislead major business decisions.

A simple example: your latest customer survey indicates that customers are very unhappy about late delivery.

You immediately action a strategy to improve delivery speed and tracking.

However, at closer inspection, you realize that responses come from customers living in rural areas who aren’t necessarily your target audience.

This means, it might still be worthwhile to improve the experience for these customers but it may not be as big a problem as the survey results suggested and investment into other areas would be more productive in improving CX for the entire customer base.

Another problem is that tracking CX metrics over time becomes very difficult due to margin of error on small sample sizes.

For example, if your NPS has fallen by 5 points in the last week but there are only a few dozen responses for each week then, statistically speaking, there is a high chance the fall is just due to noise in the data and nothing real.

This really undermines trust in VoC programmes because decision makers who rely on insights end up in limbo as to whether they can trust them or not.

The big picture effect of falling response rate is broken trust in customer insights and decision makers around the business return to the centuries old practice of gut feel - the very place we as an industry are trying to move away from!

So why is this happening?

So why are fewer and fewer customers responding to surveys?

According to researchthere are a number of causes with one of the major reasons being linked to the decline of contact rates, due to the growing volume of unsolicited emails.

This is interesting as it doesn't blame customer insights / researchers per se but focuses on customers receiving too many unsolicited emails including surveys and as a result it becomes harder to get the customer to give you time to answer your survey.

This reflects what we have seen at Chattermill - when we started out back in 2015 we saw that many brands were only starting to send regular post-transaction or post-interaction surveys via email and in general they saw very healthy response rates of 10% or even more.

Fast forward to today to see that the rise of tools such as Typeform, SurveyMonkey make it quick and cheap to send surveys at scale yet arguably getting reliable insights has become harder due to fewer people opening and responding to these surveys.

We have a number of clients that have seen response rates more than half since 2015 even though the survey itself has not changed much.

The implications of falling response rates on VoC landscape

So what does this all mean for VoC and CX?

In simple terms, survey based customer insight is at real risk of going the way of the dinosaurs because if response rates continue to fall it will make insights unreliable and unusable - there is unfortunately not that much room left for response rates to fall before this happens.

Once trust in survey results is broken, we could see nothing short of extinction of survey tools and even blue chip companies like Qualtrics and Medallia will be in real trouble as surveys are their bread and butter.

Customer Insights as a practice will likely be transferred to the Data Science team who will do their best to use big data to fill some of the gaps in understanding customers.

The outlook is indeed quite grim and we currently have little evidence of the trend reversing. In fact estimate that response rates will continue to fall around 25% per decade which puts many VoC programmes at great risk given their current response rate is already in low single-digits.

In fact, the minimum threshold that many professionals consider to be robust for representative results is a very ambitious 8%.

What should VoC professionals do to save VoC from extinction

The big question is what should we as CX and VoC insights professionals be doing about this?

The answer is it depends on your current response rate and what kind of customer insights you seek.

There are some quick wins to get response rates back up (yet it will unlikely solve the long term declining trend) and a more long term solution of moving away from relying so heavily on surveys as the source of insights.

1. Make your surveys shorter

Numerous studies suggest that adding more questions to your surveysnegatively affects response rate.

The simpler your surveys, the more likely you are to get a response.

There is no magic number for how many questions you should ask, but keeping your survey length in check means that you can increase your chance of getting a response, even by a little bit.

2. Ask well designed open end survey questions that capture more insight per response

We often suggest to our clients to send out surveys with just one specific open-ended question.

Open-ended questions ensure you can capture sentiment and pick up the topics and themes that are most important to your customers - both negative and positive.

Open-ended responses contain much more insights compared to simple ratings and paint a true picture of what your customers care about.

You just need to make sure you’re equipped to analyze open-ended responses.

3. Send surveys to relevant audiences only, instead of all your customers

Increasing the relevance of your surveys to recipients can also increase response rates.

Some of our clients have increased response rates by sending specific, relevant questions to different sets of customers.

Instead of a generic survey asking the same questions, you can try tailoring your surveys to the audience you are sending your surveys to.

All of these tactics can help you increase your response rate a little bit, but what are the long term strategies you can implement to tackle the trend of falling response rates?

The two long-term strategies to tackle falling response rates

In my view, there are two main ways in which you can tackle falling response rates:

1. Moving away from email surveys to website / in-app surveys

Given that the long term trend of falling email survey response rates is unlikely to be reversed, CX and VoC professionals should start looking at different ways they can reach their customers.

Some of our clients have had success in moving away from traditional email based surveys to asking questions at key customer journey moments on their website or in-app.

This means that they are able to capture sentiment at different stages of the customer journey and not only post-purchase or post support interaction.

But these are only quick, short term improvements. So what else can you do?

2. Diversifying the data you analyze to measure VoC

This is the number one change that I see having the biggest impact on mitigating falling response rates.

Using AI to extract customer insights from unconventional data sources such as support interactions, chat and voice, social media and online reviews is fast becoming a game changer for our clients.

There is a hidden wealth of data that many companies are capturing but are currently not analyzing.

Support interaction data, chat and voice conversations, social media and online reviews are going to become even more important in the next few years.

Using AI platforms like Chattermill to extract customer insights from these interactions means that VoC professionals can access a whole new stream of useful data to understand the friction points and wow moments in a customer’s journey.

We are seeing more and more of our clients combining those insights with survey response data and analyzing all available data sets at the same time to get a clear picture of sentiment across all customer touchpoints.

I believe that this clear, unified view will provide a real advantage to CX and VoC teams in the next decade and will prevent the loss of trust in VoC programs.

.avif)